In Southeast Asia, countries like Thailand, Vietnam, and the Philippines often attract significant attention. However, Myanmar remains relatively obscure and lacks a distinctive presence, especially in the eyes of many Chinese people. If not for major events like earthquakes, Myanmar might often be overlooked. For professionals in the wind power industry, news about Chinese wind power expanding into Southeast Asian markets is common, but information regarding Myanmar’s wind power sector has been scarce.

Myanmar’s Wind Power Resources

Myanmar’s electricity supply primarily relies on:

- Hydropower and natural gas (39.3%)

- Limited coal-fired power generation

- Minimal solar and the wind power (only 1.6%)

The country faces severe electricity shortages, insufficient grid coverage, and an unreasonable electricity pricing mechanism.

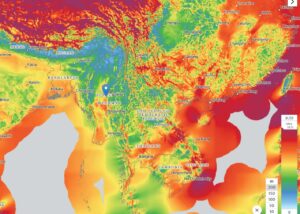

Although Myanmar’s wind power resources are not particularly outstanding, the country has diverse geography, including coastal regions, mountains, and plains—ideal conditions for the wind power generation. The southern coastal areas experience higher wind speeds, especially during the monsoon season, making them suitable for wind farm construction.

Myanmar has received international assistance for the wind power assessment. Organizations like the United Nations Development Programme (UNDP) have supported wind resource mapping and feasibility studies.

China’s Wind Power Projects in Myanmar

Under China’s Belt and Road Initiative (BRI), China has provided substantial economic and technological support to developing countries.

- In 2016, Myanmar approved a 126 MW onshore wind farm in Chaung Tha, developed by China’s Three Gorges Corporation. However, after a government transition, the project was stalled and remains inactive.

- Myanmar’s Ministry of Electricity has been conducting feasibility studies for offshore wind farms along its coastal areas.

- In 2023, Myanmar’s Ministry of Electricity partnered with Yunnan Machinery & Equipment Import & Export Company (China) to develop three wind power projects with capacities of 150 MW, 100 MW, and 110 MW.

Although Chinese media often depict the BRI as providing essential support to underdeveloped nations, Myanmar’s perception of China is more complex. Myanmar harbors a degree of apprehension towards China—it accepts Chinese assistance but does not wholeheartedly embrace Chinese cooperation.

Myanmar’s Relationship with Russia

Myanmar’s closest international partner is not China but Russia. Amid economic struggles and international sanctions, Myanmar has deepened its ties with Russia, which has helped develop nuclear power plants, ports, refineries, and other infrastructure to alleviate energy shortages while expanding Russian business interests in Asia.

Additionally, Myanmar’s military government heavily depends on Russian military equipment and technology. Since the 2021 coup, Myanmar has purchased fighter jets, drones, and air defense systems from Russia and even conducted joint military exercises.

By strengthening its ties with Russia, Myanmar aims to counterbalance China’s influence while securing more resources and support for domestic economic and social development.

On March 4, 2025, during a meeting in Moscow, Russian President Vladimir Putin and Myanmar’s leader Min Aung Hlaing announced that Russia would build a small nuclear power plant in Myanmar. Additionally, Russia committed to supporting Myanmar in nuclear power, oil, natural gas, and the Wind Energy.

Wait—Since When Did Russia Develop Wind Power?

Russia, rich in nuclear and fossil fuel energy, seems an unlikely candidate for Wind Energy development. However, in 2017, Rosatom (Russia’s state nuclear corporation) established a renewable energy division focused on the Wind Energy. This division engages in:

- Wind farm management

- Mass production of wind turbine components

- Product development, marketing, sales, and after-sales services

Rosatom’s Expanding Wind Power Business

- Rosatom is Russia’s largest power generation company and the world’s leading nuclear power corporation.

- It holds the world’s second-largest uranium reserves.

- Despite being branded as a nuclear company, Rosatom operates in diverse fields, including nuclear medicine, metallurgy, desalination, composite materials, shipbuilding, supercomputing, software development, hydropower, and the wind power.

- The corporation oversees around 450 enterprises and organizations with over 400,000 employees.

Currently, Rosatom’s Wind Energy division has a total commissioned capacity of 1.7 GW, including operational wind farms with a combined capacity of 1 GW—making it the leader in Russia’s Wind Energy sector.

Rosatom’s Wind Energy Expansion into Myanmar

Rosatom has actively pursued Wind Energy projects in Myanmar. It signed a Memorandum of Understanding (MoU) with the Myanmar government to explore the feasibility of building a 372 MW wind farm.

Russia’s Wind Power Strategy: Not for Domestic Use, But for Global Influence

Although Russia has vast land resources, approximately 65% of its territory is permafrost, unsuitable for large-scale the wind power deployment. Moreover, Russia possesses abundant oil and natural gas reserves, eliminating any urgent domestic need for renewable energy.

Instead, Russia uses the wind power as a geopolitical tool—bundling it with oil, nuclear power, and military technology to attract potential allies. Myanmar is a prime example of how Russia strategically employs Wind Energy diplomacy to expand its influence in Southeast Asia.